Introducing $INTO: The Token Powering Interchain Flows

The token powering the network that turns your intent into smart, on-chain action is coming

$INTO is the native token of the Intento Network — a Cosmos-based L1 built to orchestrate complex, self-custodial flows across the interchain.

With $INTO, we’re not just launching a token. We’re launching the coordination layer for on-chain intent execution.

To enable an intent-based L1, you need:

- Security → Validators securing the chain

- Governance → Stakeholders steering upgrades, fees, and functionality

- Incentives → Stakers, relayers, and protocol contributors all aligned

- Fee System → A native mechanism to handle cross-chain flow execution

$INTO does all this — and more:

Holding and staking $INTO allows you to:

- Earn staking rewards

- Capture a share of protocol revenue

- Save on flow execution fees compared to other tokens

- Benefit from the deflationary burn mechanism built into flow usage

Problem: On-Chain Intents Are Hard

Putting your intent on a blockchain should be simple. Say "reinvest my rewards," and it just happens. But today, that’s not the case:

- You either give up control to external wallets or smart contracts

- Or you have to build your own execution infrastructure

- Add cross-chain workflows? It becomes a nightmare

That’s the problem Intento solves.

Intento Fixes This

Intento is building crypto’s intent layer — where execution becomes programmable, flows become assets, and coordination becomes trustless.

✅ IBC-connected: Works across Cosmos chains, out of the box

✅ Secured by top Cosmos Hub validators

✅ Scalable: Millions of active flows, processed in parallel

✅ Self-custodial: You sign once. You stay in control

✅ AI-ready: Agents orchestrate flows — you approve them, on-chain

With Intento, everything remains on-chain — meaning transparent, accountable, and secure.

$INTO makes this system possible.

Token Utility

Unlike a typical gas token, $INTO is designed for programmable flows — a new way of expressing intent across the interchain.

Execution fees follow a gas-based model — more complex flows cost more. But there’s a twist:

- Interchain Queries and conditional checks are free — flows like autocompounding only execute if it’s worth it

- Fees can be paid in multiple tokens (e.g. $ATOM, $OSMO), but non-INTO fees go to the treasury, not stakers

- When paying in $INTO, part of the fee is burned per message, reducing total supply

We also support a unique feature: fallback from your wallet balance. This allows users to sign once and build flows with no upfront deposit.

Execution commissions are applied only after returning any attached fees to the flow, ensuring efficiency and fairness.

Governance Utility

$INTO is more than just a staking or fee token — it gives holders meaningful control over the network’s evolution.

Governance allows $INTO holders to:

- Propose and vote on flow-level parameters (e.g. default fees, allowed message types)

- Manage fee exemptions, execution costs, and incentives

- Approve Community Pool spending for builders, relayers, and ecosystem support

- Launch new flow features or integrations through governance-controlled upgrades

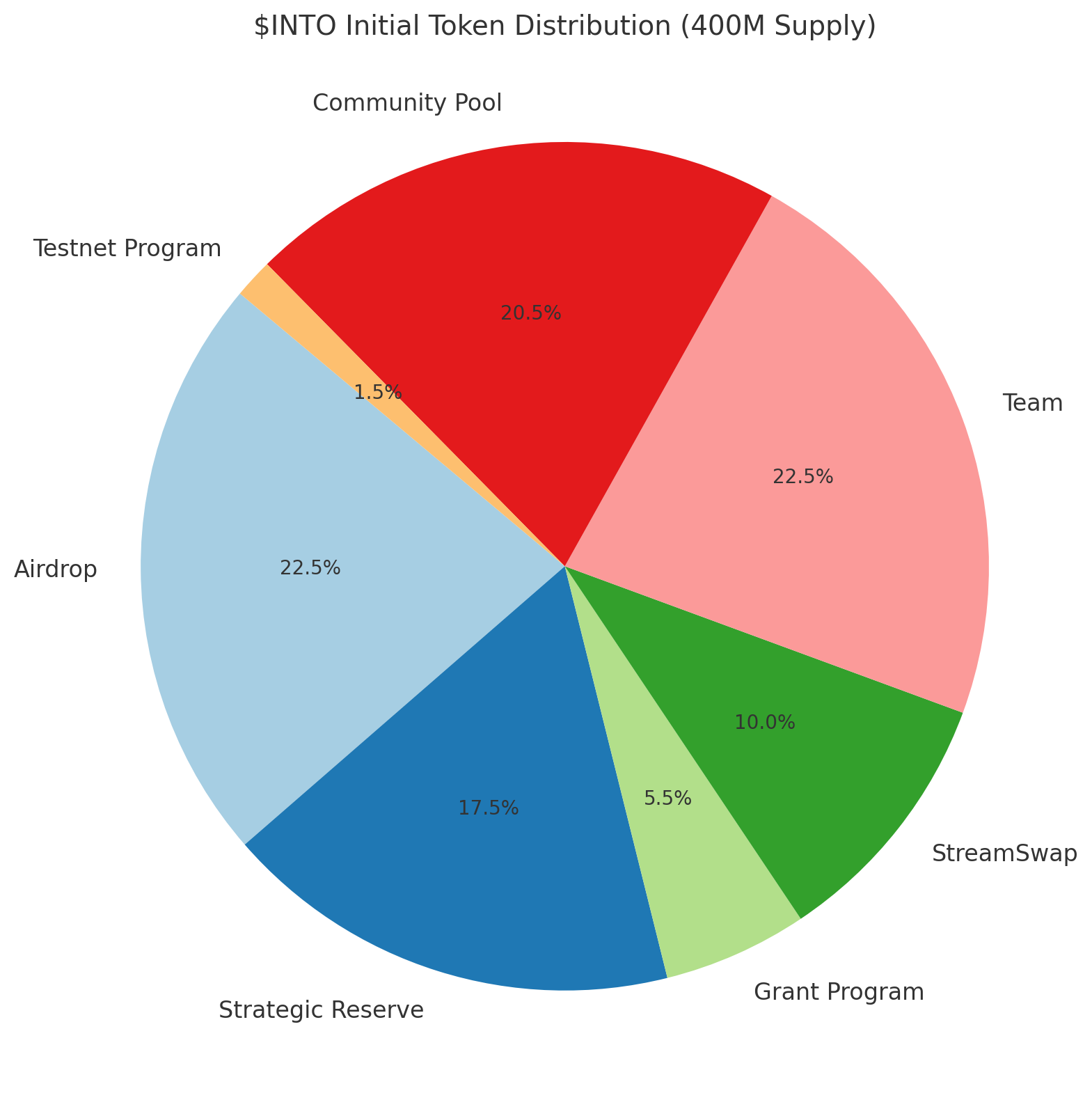

Initial Allocation

At genesis, 400 million $INTO tokens will be created.

We’ve allocated these tokens to support contributors, early users, builders, and ecosystem incentives — while maintaining flexibility for future programmatic growth.

| Category | Amount (M) | % of Supply |

|---|---|---|

| Airdrop | 90 | 22.5% |

| Team | 90 | 22.5% |

| Community Pool | 82 | 20.5% |

| Strategic Reserve | 70 | 17.5% |

| StreamSwap event | 40 | 10.0% |

| Grant Program | 22 | 5.5% |

| Testnet Program | 6 | 1.5% |

| Total | 400M | 100% |

Note on Liquid Tokens: The most immediately liquid allocations are the StreamSwap event, Airdrop and Testnet Program, happening around mainnet launch. Other allocations, such as Team and Grant Program, are subject to long-term continuous vesting.

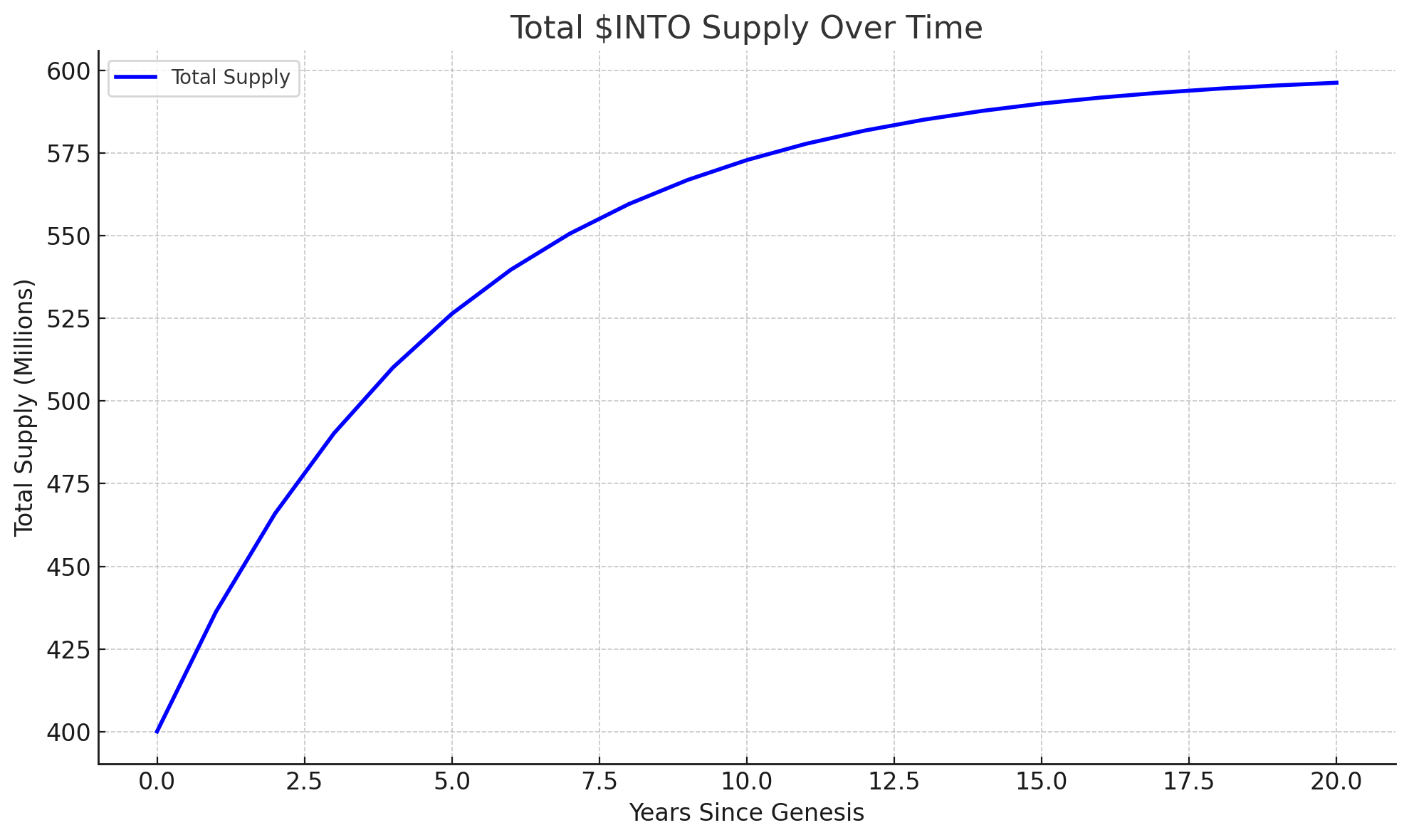

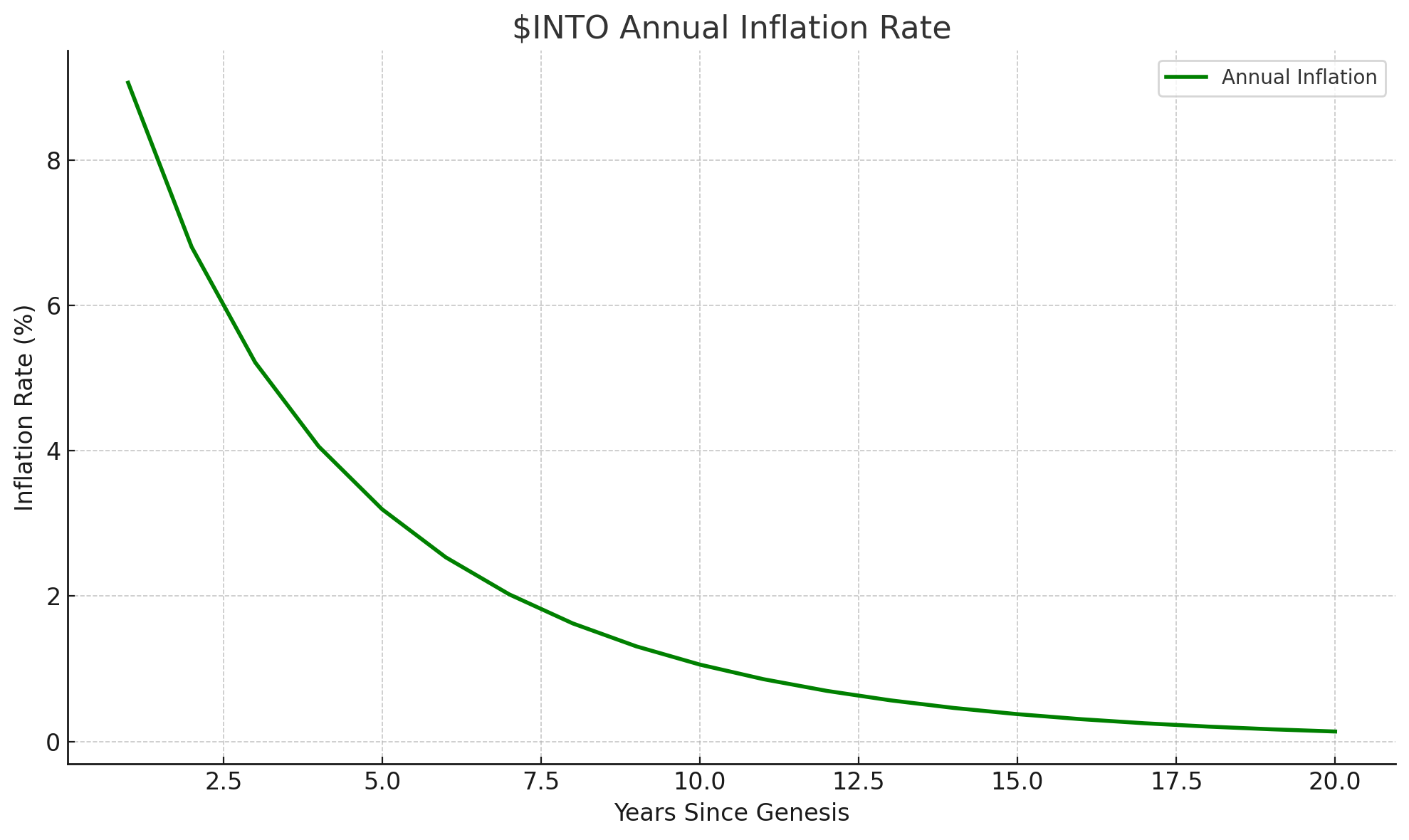

Emission Schedule

Rather than frontloading rewards, $INTO follows a 20-year emission schedule designed to scale with real protocol usage.

- Inflation starts at 10% and decreases by 25% YoY, reaching near-zero after year 10.

- Total supply grows from 400M → ~559M over two decades.

- Emissions are split:

◦ 70% to the community pool

◦ 25% to stakers, shared between stakers of $ATOM and $INTO

◦ 5% to IBC relayers, powering intent-based flows across chains

This distribution is governed by $INTO stakers and can evolve as Intento scales.

Designed for durability, built for alignment.

| Year | Supply (M) | Annual Inflation |

|---|---|---|

| 0 | 400 | - |

| 1 | 440 | 10.0% |

| 3 | 470 | 6.8% |

| 5 | 509 | 3.4% |

| 10 | 548 | 0.7% |

| 20 | 559 | 0.0% |

Unlock Schedule

To align with protocol growth and contribution over time, we use continuous vesting across all major allocations — with no cliffs. This structure avoids sudden supply shocks, rewards consistent alignment, and gives contributors time-based accountability.

| Allocation | Vesting Model |

|---|---|

| Team | Continuous vesting over 5 years |

| Strategic Reserve | 50% available, 50% continuous vesting over 5 years |

| Grant Program | Continuous vesting over 5 years |

| Airdrop | Short-term vesting (4 actions over days/weeks) |

50% of the Strategic Reserve is liquid at launch, available for high-impact initiatives such as partnerships, liquidity incentives, or ecosystem expansion. The remaining 50% vests linearly over 5 years, ensuring alignment with long-term growth.

Airdrop: Big, But Smart

The airdrop is one of the boldest parts of $INTO’s launch — but it’s also designed with accountability.

- 22.5% (90M tokens) allocated to eligible users

- Claimable via the Intento Portal

- Clawback logic: unclaimed tokens return to the treasury

This means:

If you want $INTO, you’ll need to use the protocol.

Whether that’s flowing assets, running autocompounding flows, or contributing to governance — $INTO flows to those who participate.

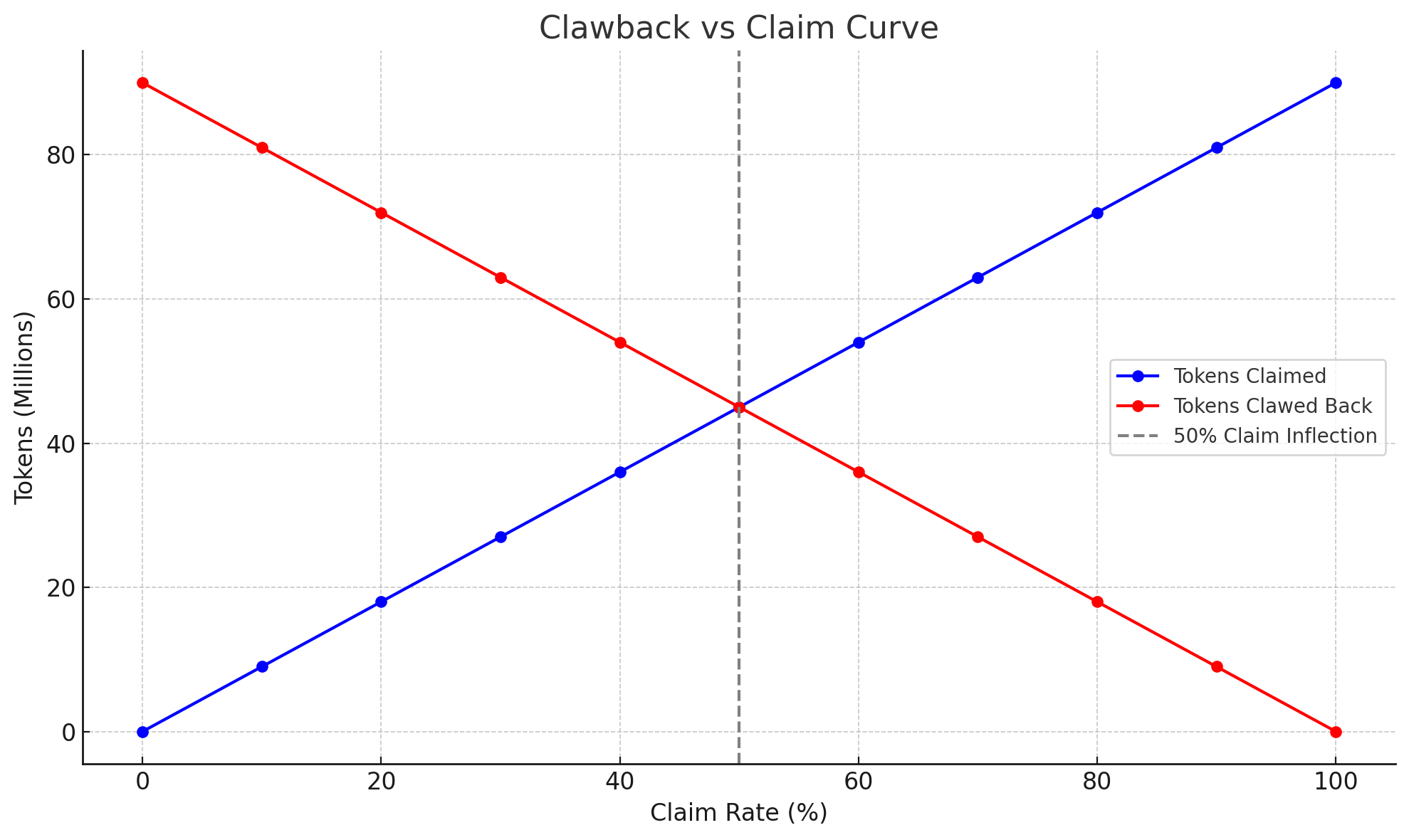

🪃 The Clawback Model

Most airdrops waste supply on wallets that never engage. Ours doesn’t.

Claim Rate Impact

| Claim Rate | Tokens Distributed | Clawed Back |

|---|---|---|

| 20% | 18M | 72M |

| 50% | 45M | 45M |

| 80% | 72M | 18M |

This model gives us flexibility, fairness, and defensibility — all without over-allocating too early.

🎯 Unlocking & Claims

- Claims are triggered by completing flows

- You’ll need to connect and act through the Intento Portal

- Claim eligibility checker will be announced at mainnet launch

Claims are unlocked through user actions completed over a few days — not to delay access, but to ensure engagement. Combined with a staking requirement, this helps attract aligned, long-term users and filters out sybil or passive claimants.

We believe in rewarding meaningful usage, not just wallets that exist.

Flow Fees

$INTO isn’t just for staking or governance — it fuels the actual execution of intent-based flows.

Modular, Message-Based Fee System

- Flows are charged per message and per step.

- Simpler flows cost less; complex flows cost more.

- Fees scale predictably with flow design.

For example, a single-token swap flow may cost less than a multi-hop IBC transfer with conditional logic.

Smart Optimizations

To encourage efficient design, the protocol makes some actions complimentary:

| Component | Fee Charged? | Notes |

|---|---|---|

| Condition Checks | ❌ Exempt | Free to check conditions, query balances, prices, rewards, etc. |

| Msgs in Flow | ✅ Yes | Charged per message |

| Execution Steps | ✅ Yes | Billed based on flow complexity |

This means you can:

- Autocompound only when rewards exceed X tokens

- Run conditional flows without paying for unused branches

- Save fees with gas-efficient structures

Wallet Fallback = Frictionless UX

- No need to pre-deposit fees.

- Flows can use your main wallet balance.

- This unique fallback model makes composition easier, especially for end users and dApps.

We recommend setting flows without attaching fees, using wallet fallback for simplicity.

Multi-Token Fee Support

Revenue from fees is sent to the Community Pool, where governance can vote to reinvest, distribute to stakers, or burn the tokens.

Learn more about fees in the docs

- Pay flow fees in INTO, ATOM, or OSMO

- If paid in non-$INTO tokens: fees go to the protocol treasury

- If paid in $INTO: a portion is burned per message, reducing supply

🔥 $INTO becomes scarcer as more flows are executed — a deflationary loop tied to real usage.

What Comes Next

Intento is uniquely positioned as the go-to framework for user intents across crypto — built on the most advanced Cosmos-native tech with the strongest self-custodial automation model out there. We’re scaling rapidly by expanding chain support, integrating AI and AI Agents as core inputs, and embedding our tech across multiple products to capture the future of decentralized intent orchestration.

Upcoming milestones ahead:

- ✅ Intento Portal’s CocoChill and tokenstream.fun’s Pulsaro Quests end on 15 august. Participants will be eligible for the Intento airdrop.

- 📅 Mainnet expected August 27

- 🌐 Intento Portal and flow templates live on mainnet, StreamSwap and more

- 🛰️ tokenstream.fun live on mainnet - first DeFi product to stream any token to any token on any chain

- 🔑 Airdrop claiming and inflation goes live via governance

Builders, relayers, and validators can start aligning with intent-based infrastructure — powered by $INTO.

$INTO Matters

Intento isn’t just fixing fragmented infra — it’s building the foundation for how intent moves across crypto. Crypto was missing glue. Intents were fragmented, scattered across chains, wallets, and scripts.

Intento fixes this. $INTO powers it.

$INTO powers it all:

A high-utility token designed to align relayers, validators, and users across chains.

- No VC unlocks. No cliffs.

- Every flow burns. Every action strengthens the network.

- Used for fees, staking, governance, and discounts on core infra.

- Built on the most advanced Cosmos-native stack — and ready for AI agents.

As flows scale from simple swaps to AI-directed automation, $INTO is what holds it all together:

A high-value coordination layer for the next wave of crypto adoption — programmable, deflationary, and owned by those who build and use it.

Every flow strengthens the network. Every execution feeds the treasury, burns supply, and drives alignment.

This isn’t a token you trade.

It’s one you hold, amplify, and build with — because you're part of the system it powers.

Own $INTO, and you don’t just react to where crypto is going.

You help orchestrate it.